WealthProtect Status Update: January 2022

Reginald A.T. Armstrong • WealthProtect Status Update

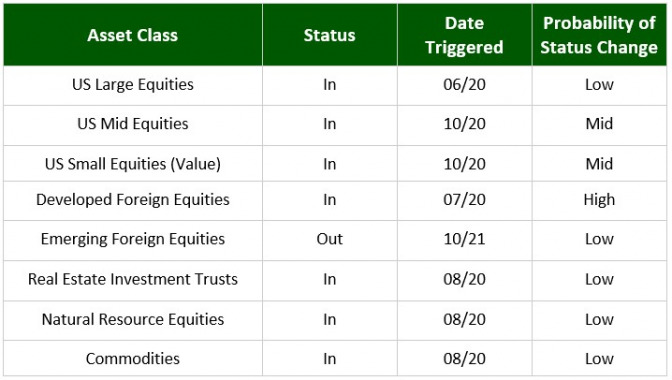

This is the monthly WealthProtect System* status update, where we include probability (Low, Mid, High) of a change in status within the next two months. We also include a commentary on actions taken this month, changes in overall asset allocation, and on the market in general.

System Commentary

No triggers this month, but foreign equities continue to flirt with their trigger line.

Economic/Market Commentary

The big news is that inflation is annualizing at 7% (and if using the same formula as 40 years ago it would be above 11%). The realization hit in the first week of the year that the Federal Reserve is way behind in controlling inflation and interest rates jumped up. This hurt just about every sort of fixed income, including TIPS (Treasury Inflation-Protected Securities) which had done well last year due to inflation. So, the Federal Reserve needs to raise rates to curb inflation, yet they run the risk of choking off the economy if they raise rates too high too quickly. The risk of stagflation or outright recession looms. In addition, an expensive market means that in any selloff the Fed will be tempted to lower rates to shore up the markets, possibly causing even more problems.

So, which investments do well during times of inflation and rising rates? On the equity side, commodities, natural resource stocks, infrastructure stocks, and real estate tend to perform better. On the fixed income side, TIPS, senior bank loan (floating rate) bonds, and high yield bonds have helped much of the time. Each of these options, however, has risk. Floating rate and high-yield bonds, for example, have credit risks that, should we enter a recession, could impact returns negatively. So, how have we navigated these waters?

Portfolio

In some of our models, we follow an indicator to help guide whether we are in the type of environment that is more beneficial to commodity investments versus US stocks or foreign stocks. Currently, this indicator still recommends US holdings, therefore we have not loaded up on all the investments mentioned above.

Still, we do have some inflation-fighting holdings. Global real estate is a normal part of many of our models. Eighteen months ago, we added TIPS. Several months ago, we added infrastructure stocks. This month, we did two major shifts since it was time to rebalance portfolios anyway. On the equity side, we added infrastructure stocks to more models, and we tilted a bit more towards value-style stocks that tend to do better in a rising rate/inflationary times. On the bond side, we shifted 40% to 50% of our bond allocation to a multi-strategy investment designed to be less exposed to bond risk, yet still have low exposure to stock risk without taking on extra credit risk. We sold half of our core bond position and all of our TIPS position for this. We sold the TIPS as their behavior in the past several weeks suggests they may react more to the removal of liquidity by the Fed than inflation. Also, while higher inflation may continue for many months, we may be close to the peak.

This is probably more detail than you wanted. Keep in mind, these models are in our Strategic Asset Management type accounts. Your investments may be in different types of accounts that you and your wealth manager selected; therefore, the investment style will vary.

We wish you a fantastic year. Thanks for your continued trust.